Everyone needs a house to dwell in, some people choose to buy a new apartment in residential societies of a prime area for modern living & some people choose to buy a piece of land to construct their own house. For both purposes, you need the money and you can get that from financial institutions. It does not sound different to many people to buy a new house or a plot of land, although all transactions can be referred to as purchasing a property in common parlance; but, when applying for land loans, there are variations that must be addressed:

For already built homes, under-construction homes, or those which will be built in the future, homeowners use home loans. Those who want to buy land, whether for building a house or simply for investment purposes, however, can not apply for a home loan and must go for a land loan instead.

The due diligence process performed by the lenders for handling all forms of loans is exactly the same, regardless of whether you apply for a home loan or a land loan. Your credit score still plays a major role, whether it be for a home loan or a land loan, in your home loan application process.

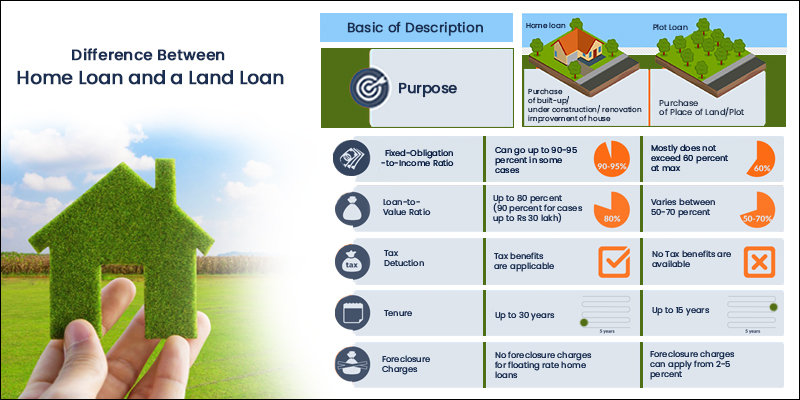

While the application procedures, terms and conditions, and the tenure of the loan, are about the same with both home loan and land loan, there are some basic differences between the two:

Property Location and Purpose:

The land loan is for residential plots only. The land should be within the limits of the municipality or corporation. If you are purchasing agricultural land, you would not be eligible for a land loan. It should be remembered that the property should not be situated in an industrial area or a village.

These plots may be in a housing society, or resale plots in a development authority scheme, or a plot of land within the limits of the city or plots outside the limits of the city. It should be certified by a competent authority, solely for residential purposes. But after the purchase, you will be liable for a home loan for the building of your house on that property.

Home loans may, however, be used for ready homes, homes under development, or for self-construction. Home loans on all properties, regardless of their location or type, are available.

Loan to Value Ratio (LTV)/Loan to Cost Ratio (LCR):

The LTV / LCR ratio is the sum of the loan you will obtain against the property’s value/cost. The LTV / LCR ratio for home loans is around 75-90 percent (i.e., based on the loan size, the borrower may typically secure a loan of about 75-90 percent of the value/cost of the property).

In the case of a land loan, based on the loan size, the overall LTV is set at 75-80 percent of the property valuation, which ensures that you will have to raise the remaining 20-25 percent on your own.

Therefore, you will need to make a down payment of at least 20 percent of the plot value if you are considering purchasing a plot of land for your personal use or as an investment.

Fixed Obligation to Income Ratio:

Dependent on the applicant’s Net Adjusted Salary, the fixed-obligation-to-income ratio is given up to 60 percent in plot loans while it can go up to 90-95 percent in the home loan.

Duration of The Loan:

In contrast to land loans, the loan term of home loans is much longer. Home loans are eligible for a period of 30 years, while land loans are eligible for a maximum of 15 years of tenure. After taking a plot loan, the purchaser must also make the purchase within 2 years of obtaining the approval of the bank.

Tax Benefits:

When you take out a home loan, tax deductions on both the principal amount and the rate of interest will be used. Land loans, on the other hand, are not qualified for any tax benefits. However, if you build a house on a land plot, tax deductions are possible, but only for the value of the loan taken towards the building. These benefits can be used only after the building project is finished.

Home Loan Interest Rate vs. Land Loan Interest Rate:

Banks and other lenders charge equal interest rates on both home loans and property loans. However, the home loan interest rates are a few percentage points lower than the land loan interest rates. Plot loans are generally riskier and thus priced higher than home loans, where banks have a promise that, if necessary, they can sell and recover losses quickly.

Although the lender imposes similar payment charges on all forms of loans, certain small distinctions can be made on the basis of the borrower’s profile. Besides, few banks also give women borrowers lower interest rates. To make it easier for you to understand the key difference, we have categorized the difference between a home loan and land loan:

SBP Group believes that while there are many similarities and distinctions between the two financial services, a customer must have a good view of home loan and land loan to decide which option will be sufficient for his particular needs. As the concept of loan involves many factors and layman may or may not be able to understand each of them.

For any more information regarding Home loans, interest rate, premium property for residential purposes, etc. you can check our other articles.